Sale Ending This Week

[ Giving Credit Where Credit Is Due Shows You... ]

“How to Escape Credit Anxiety Fast: Fix Late Payments, Student Loans, Charge-Offs, and Collections Using a Proven Legal Process That Works in Weeks.”

Stop wasting months hoping your credit improves and start using a proven blueprint that gets results in weeks.

Your Window to Boost 100+ Points Is Closing—Download the Full System Today!!

“The Last Credit Repair System You’ll Ever Need”

We’re going to show you how to repair your credit

and how to use a proven legal-first system to raise your score, remove damaging accounts, and finally GET APPROVED—without wasting years trying to figure it out…

We’re going to show you what credit repair is really for…

And how to use the laws, the dispute process, and the right documentation to take control of your financial profile, instead of letting outdated or inaccurate reporting control you.

Credit repair is commonly random, and most people attempt it with no grand strategy or intention besides “sending a letter and hoping it works.”

That’s why most people stay stuck with the same score and the same denials.

The intention of credit repair is to manage the data

and to eliminate the future objections lenders will have when they evaluate your creditworthiness.

Every dispute you send is meant to manage the way bureaus are viewing you and your financial history.

Your dispute strategy can also address the objections that will eventually come up later in the lending process—late payments, collections, inquiries, reporting errors—before a lender ever sees them.

To be clear, credit repair is NOT arguing with the bureaus…

Nor are you admitting fault, or acknowledging that you're “trying to escape a debt.”

Agencies are for selling,

a proper dispute system is for belief management, data correction, and objection removal—so lenders view you as a lower-risk, higher-approval borrower.

And your credit repair efforts must be visible. Documented. Structured.

Most people are struggling with scores that barely move, with disputes ignored or recycled, because their process is not organized enough to force compliance.

Lenders are judging you on this, silently forming opinions about your risk long before you ever submit an application.

Lenders also judge you based on how much negative reporting your file still has…

It’s a safer approval if your profile shows accuracy, consistency, and clean documentation.

Corrected accounts and updated reporting matter because they become “retargetable signals”

inside the lending ecosystem.

This is the new qualifier for determining—in a cost-effective way—who gets approved and who doesn’t.

Every dispute you send, every error you remove, every outdated account you challenge…

becomes a financial engagement signal that lenders use to reassess your risk.

And that corrected data remains “targetable” for months—sometimes an entire year—which is why scores often rise faster the moment accuracy is restored.

Distributing your disputes correctly—sequenced, documented, and structured—and THEN rebuilding strategically gives borrowers drastically better outcomes than the random, one-off methods most people try.

It’s cheaper, faster, and far more effective than the standard “send a letter and pray” approach.

And whether you choose to continue on your own with this full toolkit,

or eventually decide to partner with a professional service like Prestige Financial Rebuilders,

the foundation you build here makes every step forward easier, faster, and more impactful.

And for the first time ever…

I’ve taken the core pillars of real credit repair

and unified them

into one complete system for you to use.

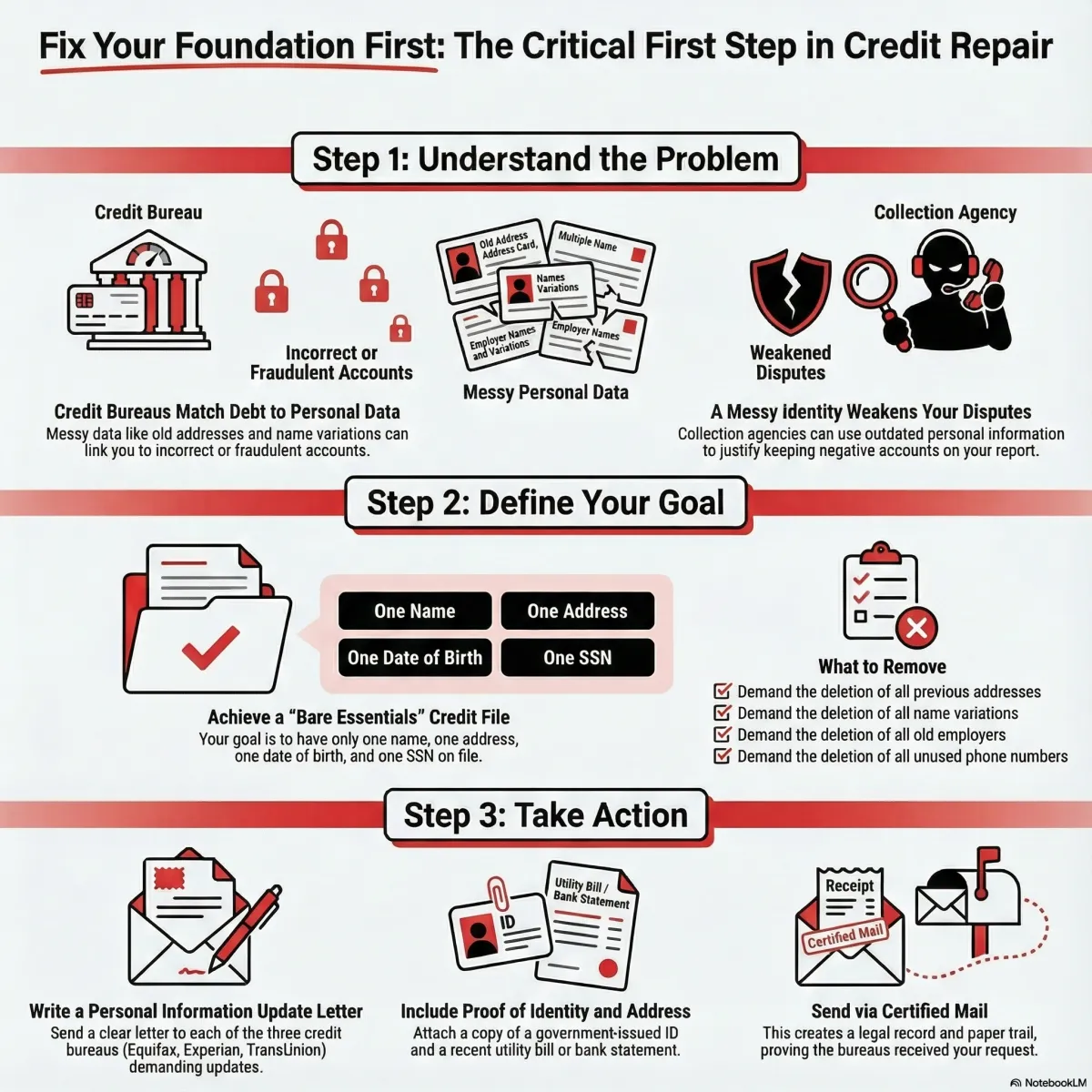

The Identity Clean-Up Principle

The book begins with identity cleanup because it’s the step that makes every dispute stronger.

Incorrect personal data causes bureaus to match you with the wrong accounts, slowing or stopping deletions.

Removing old addresses and name variations protects you, improves accuracy, and raises the success rate of every dispute you send.

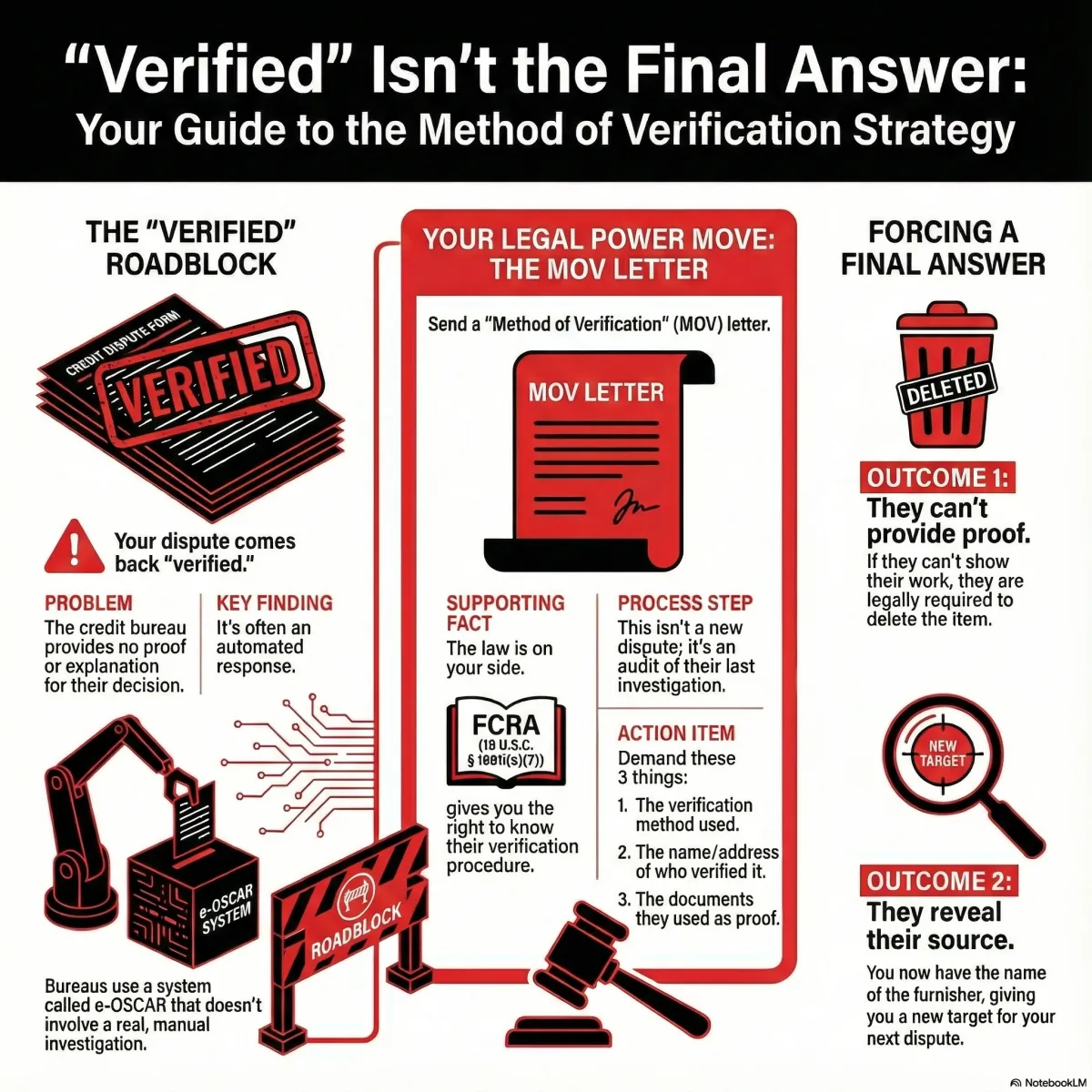

The Method of Verification Strategy

This step lets you ask the credit bureaus to prove how they “verified” an account.

Most people get a quick “verified” message with no details, usually sent by an automatic system.

This method forces the bureaus to show what they checked, what documents they used, and who confirmed the account.

If they can’t prove it’s accurate, the law is on your side—and the item has to be removed.

The First Strike Dispute System

This is when you move from getting your paperwork ready to actually challenging accounts that are wrong, outdated, or can’t be verified.

It’s your first real chance to remove negative items. The law gives the bureaus 30 days to check the account—and if they can’t prove it’s correct, it has to be deleted.

This step works for anyone starting disputes. It makes sure your first round is done the right way so you get the best results, not ignored or brushed aside.

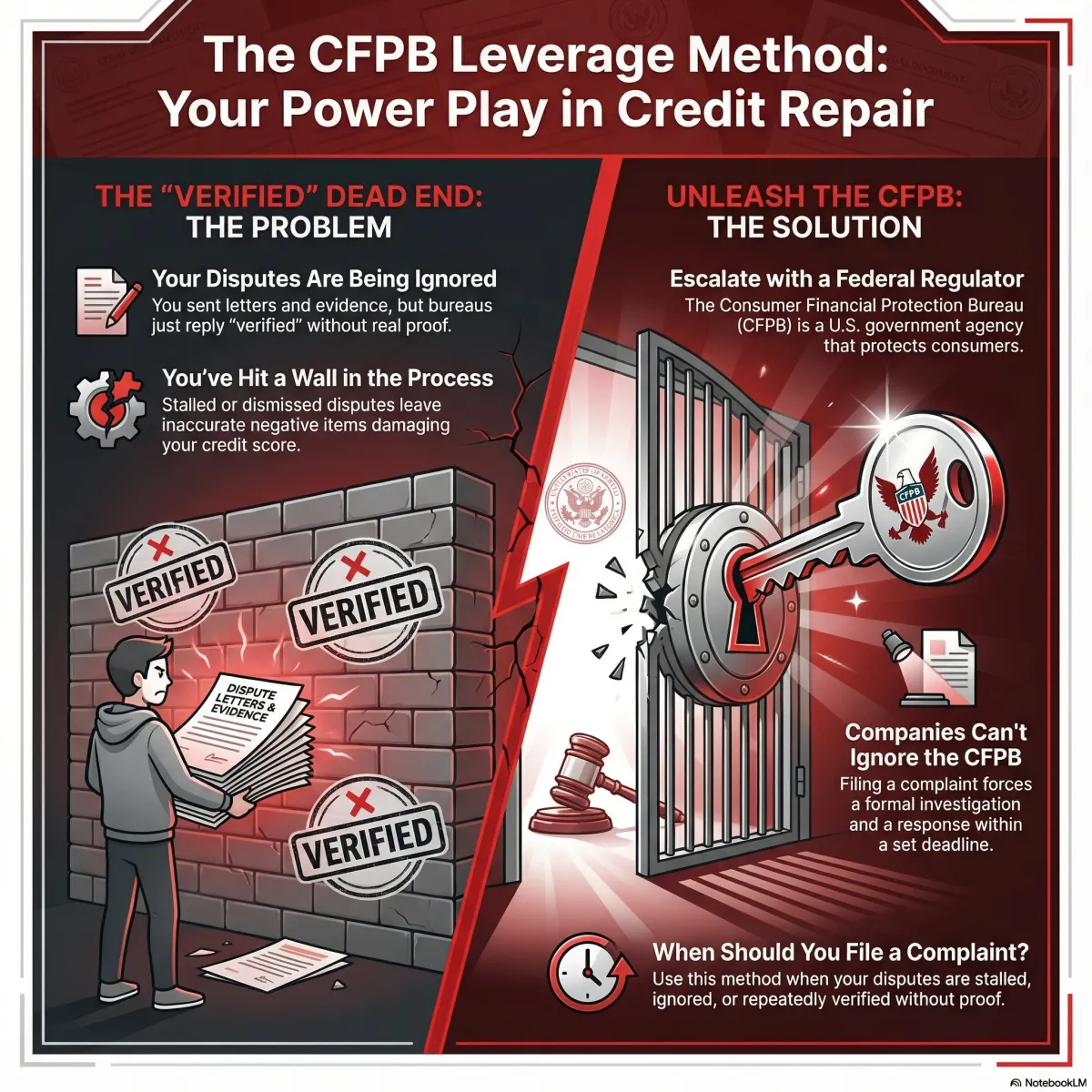

The CFPB Leverage Method

When the credit bureaus stop responding or keep saying an account is “verified” without showing proof, this method brings in a government agency they can’t ignore.

By filing a complaint with the CFPB and adding your evidence, you force the bureaus and the company reporting the debt to respond and explain what they did.

Businesses might ignore your letters, but they do not ignore the CFPB.

This method is for anyone who feels stuck. It turns your paperwork into real pressure—and that pressure often leads to faster fixes and removals.

The Identity Theft & Data Breach Removal System

This method helps you remove accounts and inquiries caused by identity theft or data breaches using your legal rights.

When you send the right documents, the law allows these fake accounts to be blocked or removed in as little as four business days.

This is important today because fraud and unauthorized accounts are more common than ever.

The process uses FTC reports, strict time limits, and CFPB escalation if needed. It helps clear fraud fast, restore lost points, and protect your credit from future damage.

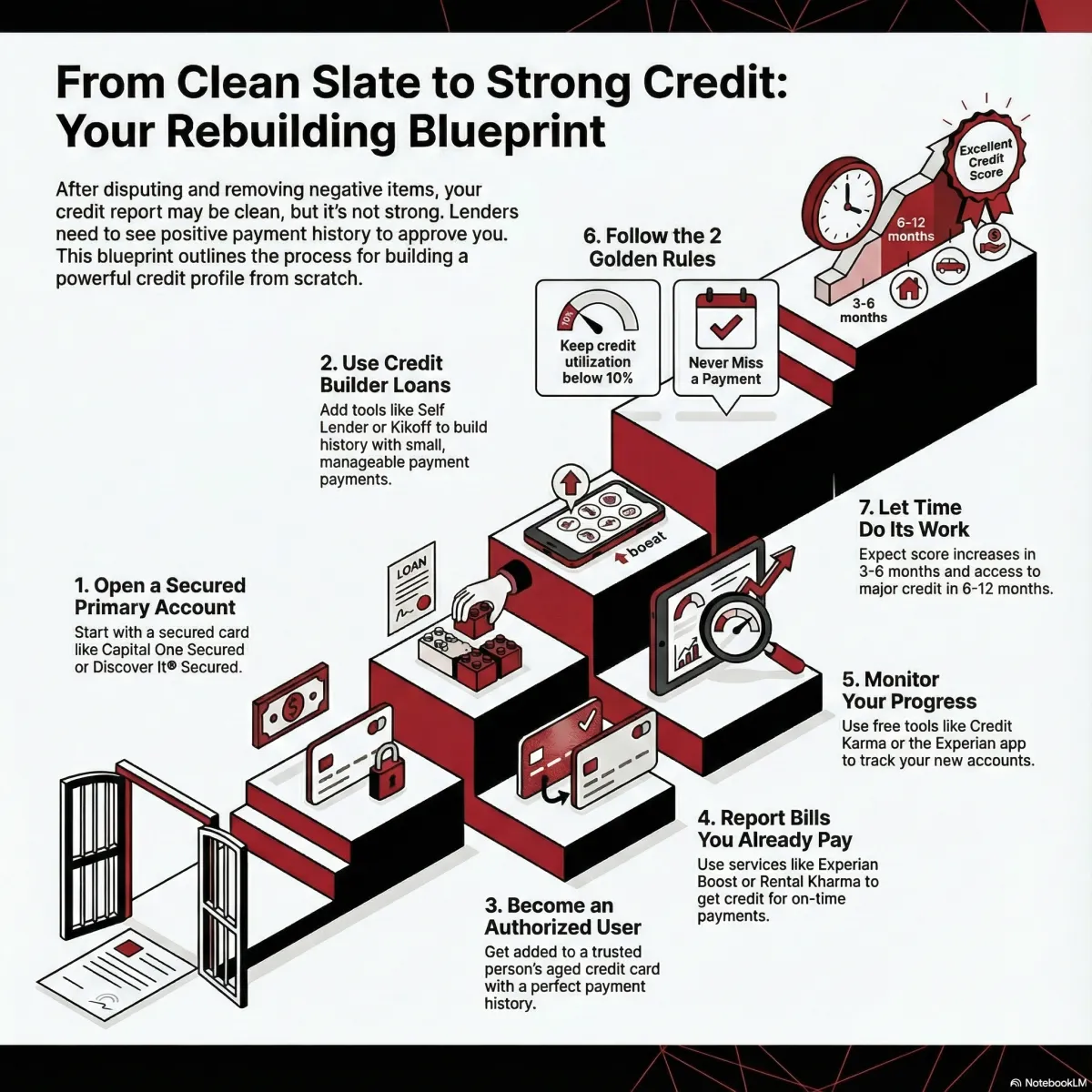

The Rebuilding From Scratch Blueprint

This method shows you how to turn a clean credit report into a strong, high-scoring profile lenders will trust.

A clean report isn’t the finish line. You still need new, positive credit history to get real approvals.

This blueprint teaches you how to open secured accounts, use builder loans, add authorized users, and stack tools like Experian Boost and Rental Kharma to build score momentum.

It’s for anyone who cleared negative items and now needs to build fresh credit data. This is how clean credit becomes strong credit—and strong credit becomes approvals.

I’ve spent years refining these strategies, and HUNDREDS of clients have used them inside Prestige Financial Rebuilders.

By no means is this untested.

These are the exact legal methods and dispute systems I’ve created and proven through real cases—not copied from forums or recycled templates.

These are proven templates designed to expedite your credit repair process.

These are all tried and true legal strategies that work

There have even been a few people I’ve had to warn legally because they tried to duplicate this work and claim it as their own (not naming names, not my style lol).

Point is, these strategies help you fix your credit faster and cheaper than anything you’re doing now—especially if you’ve only tried random disputes or guessing your way through the process.

Ready To Fix Your Credit Once And For All?

We're Not Done yet..

We're so locked in on helping you succeed that we've even included These bonuses for free!!!!

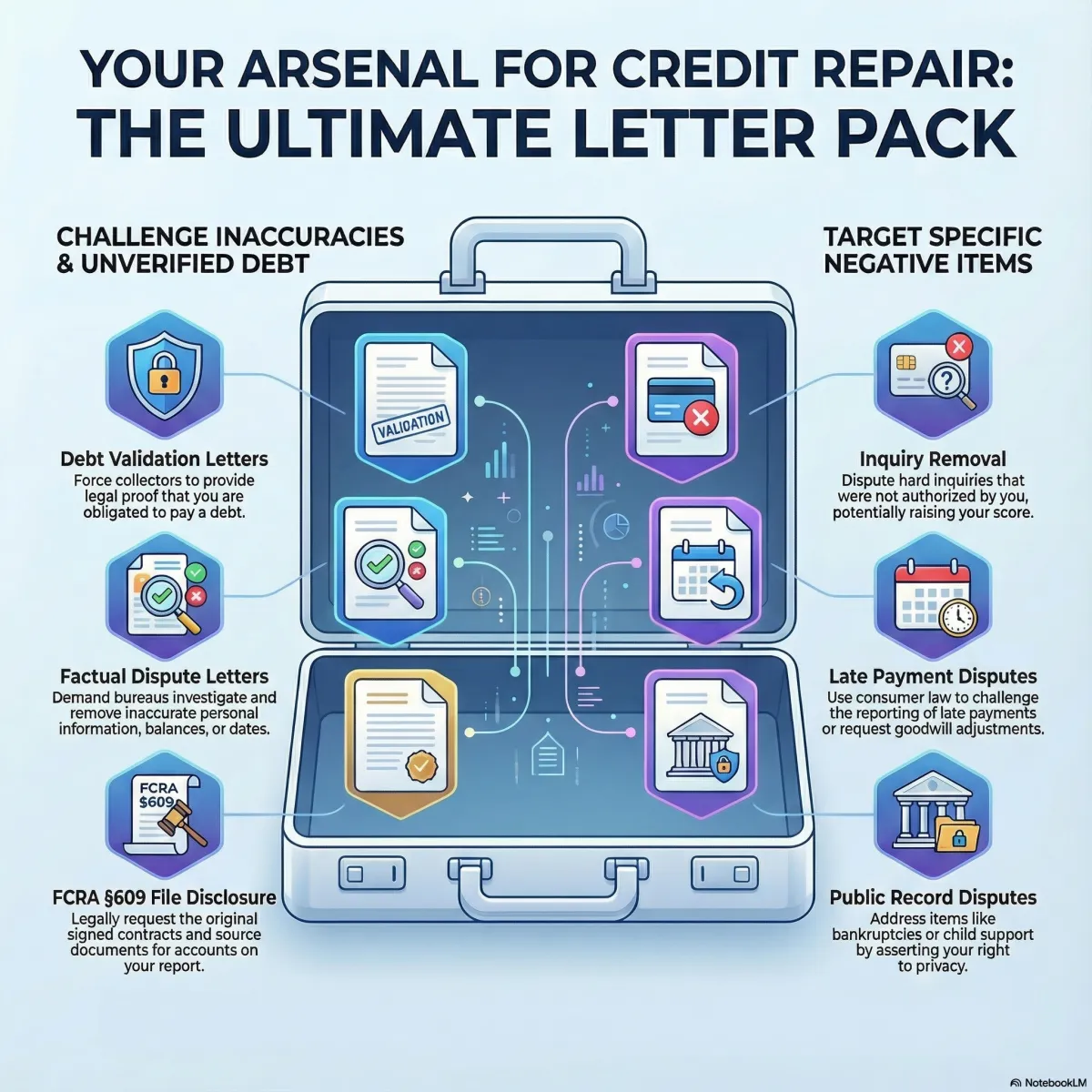

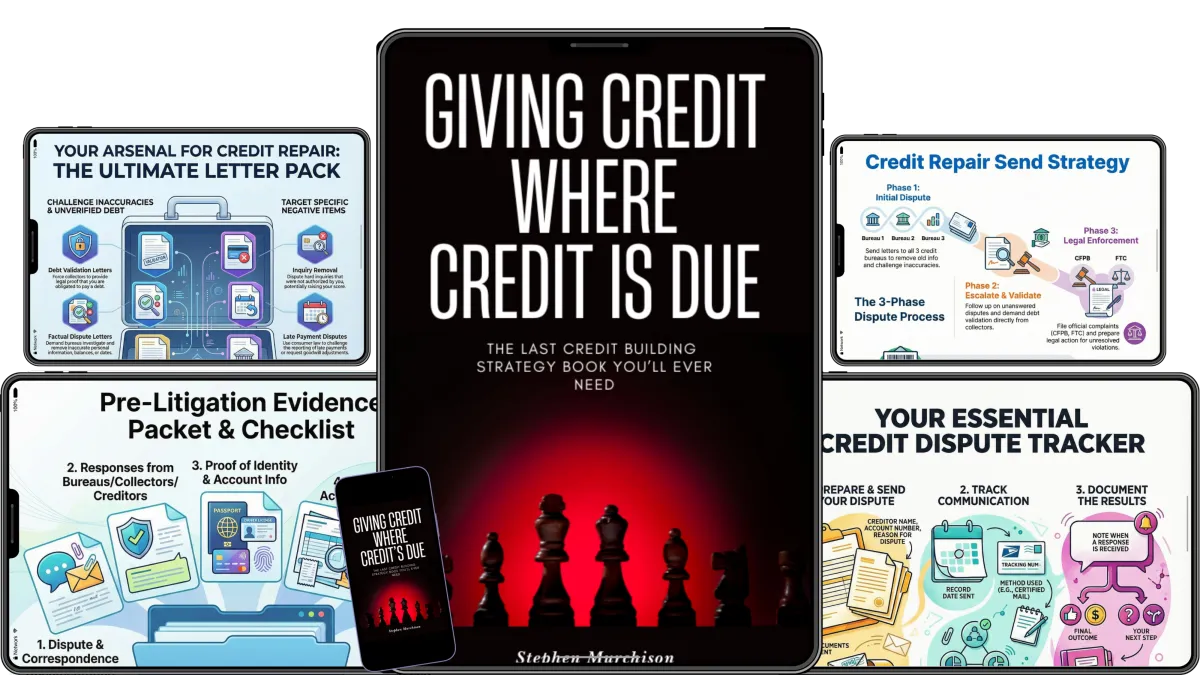

Credit Removal Letters

Templates

Proven dispute letters for late payments, collections, charge-offs, inquiries, and more. Just copy, customize, and send for faster, cleaner results.

$500 DOLLAR VALUE

INCLUDED

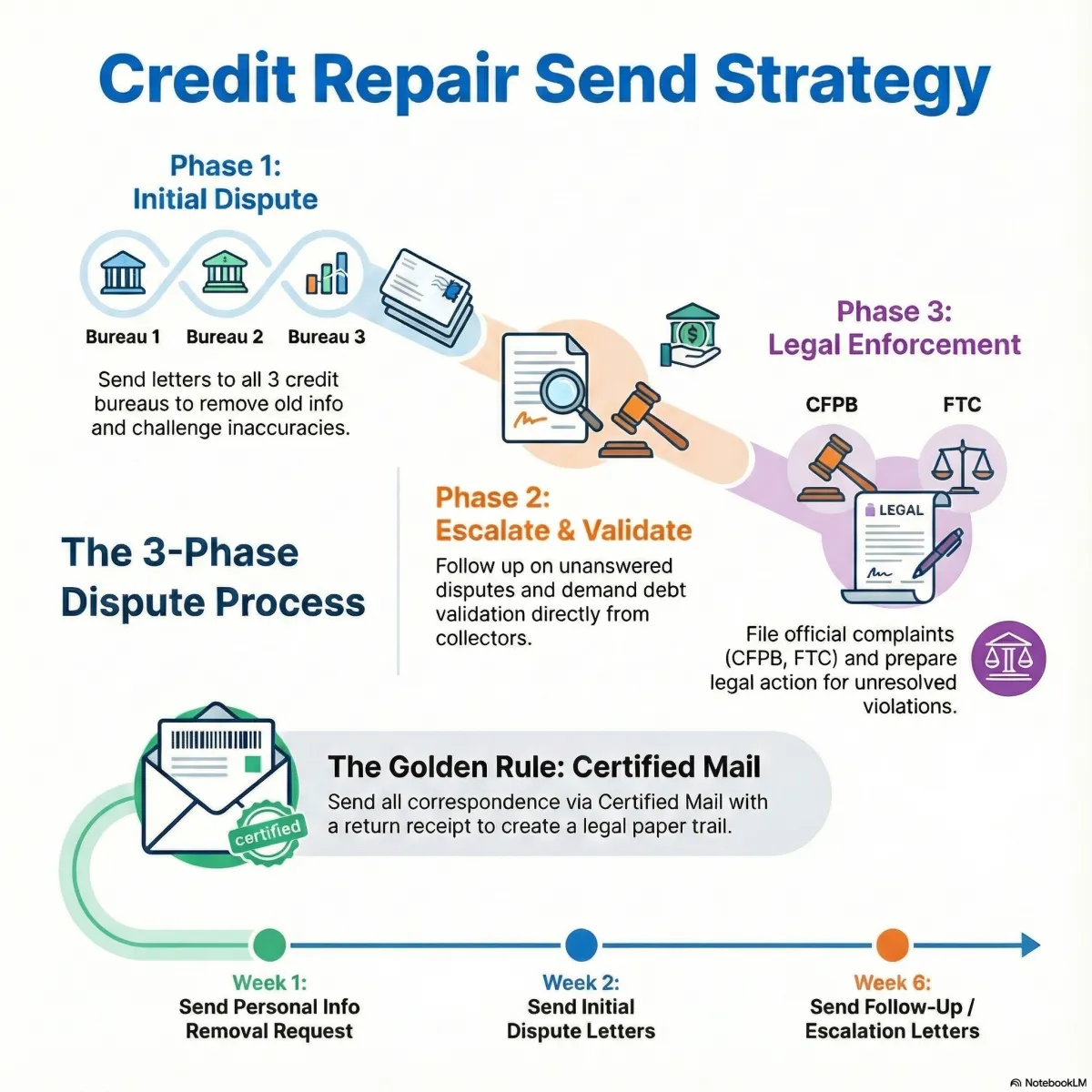

Credit Repair Send Strategy

Google Doc.

Your step-by-step roadmap for what to send, when to send it, and how to trigger legal compliance. Eliminates confusion and maximizes deletions.

$147 DOLLAR VALUE

INCLUDED

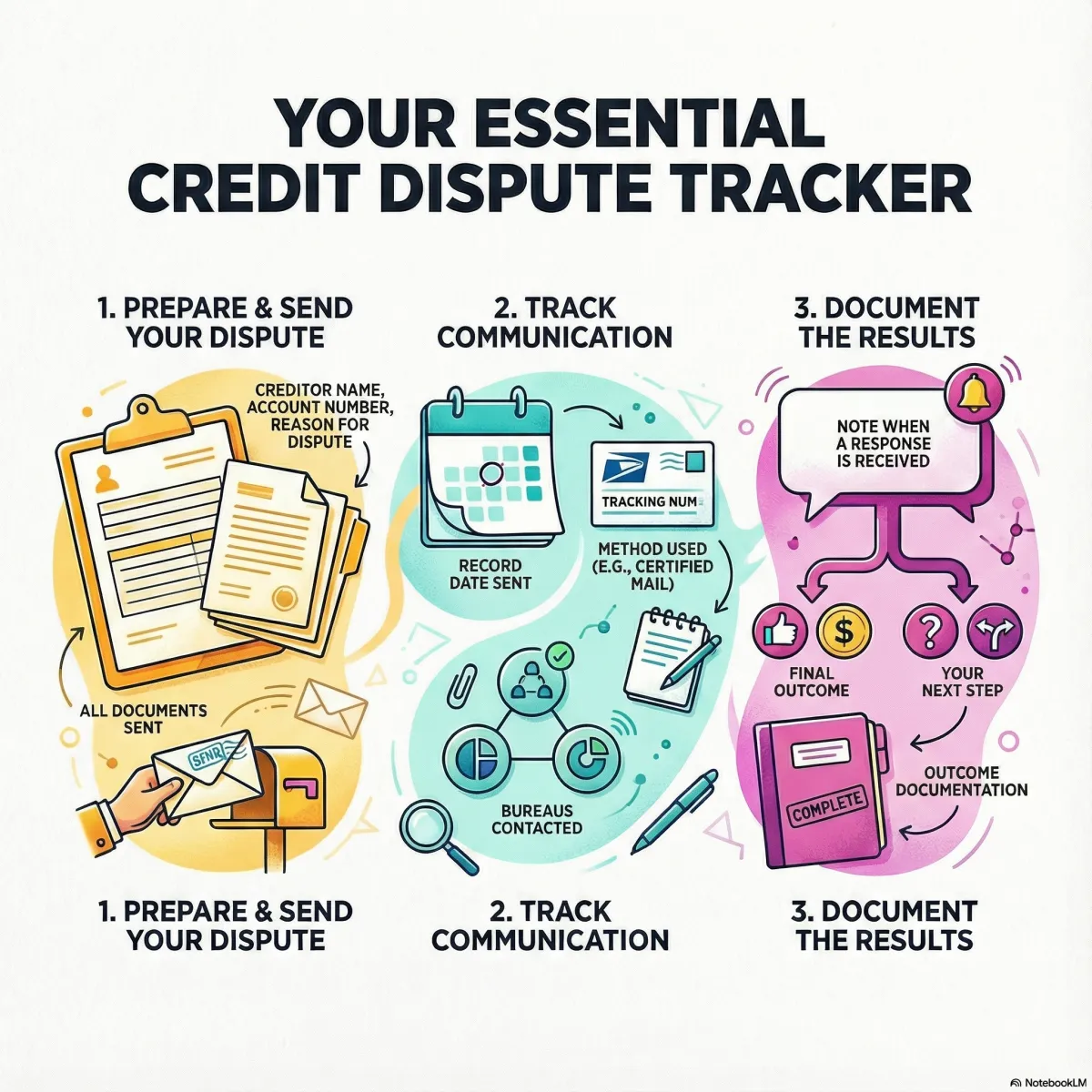

Dispute Tracker Checklist

Google Spreadsheet

Track every round, deadline, and response in one clean system. Never miss a timeline, lose documentation, or stall your progress again.

$97 DOLLAR VALUE

INCLUDED

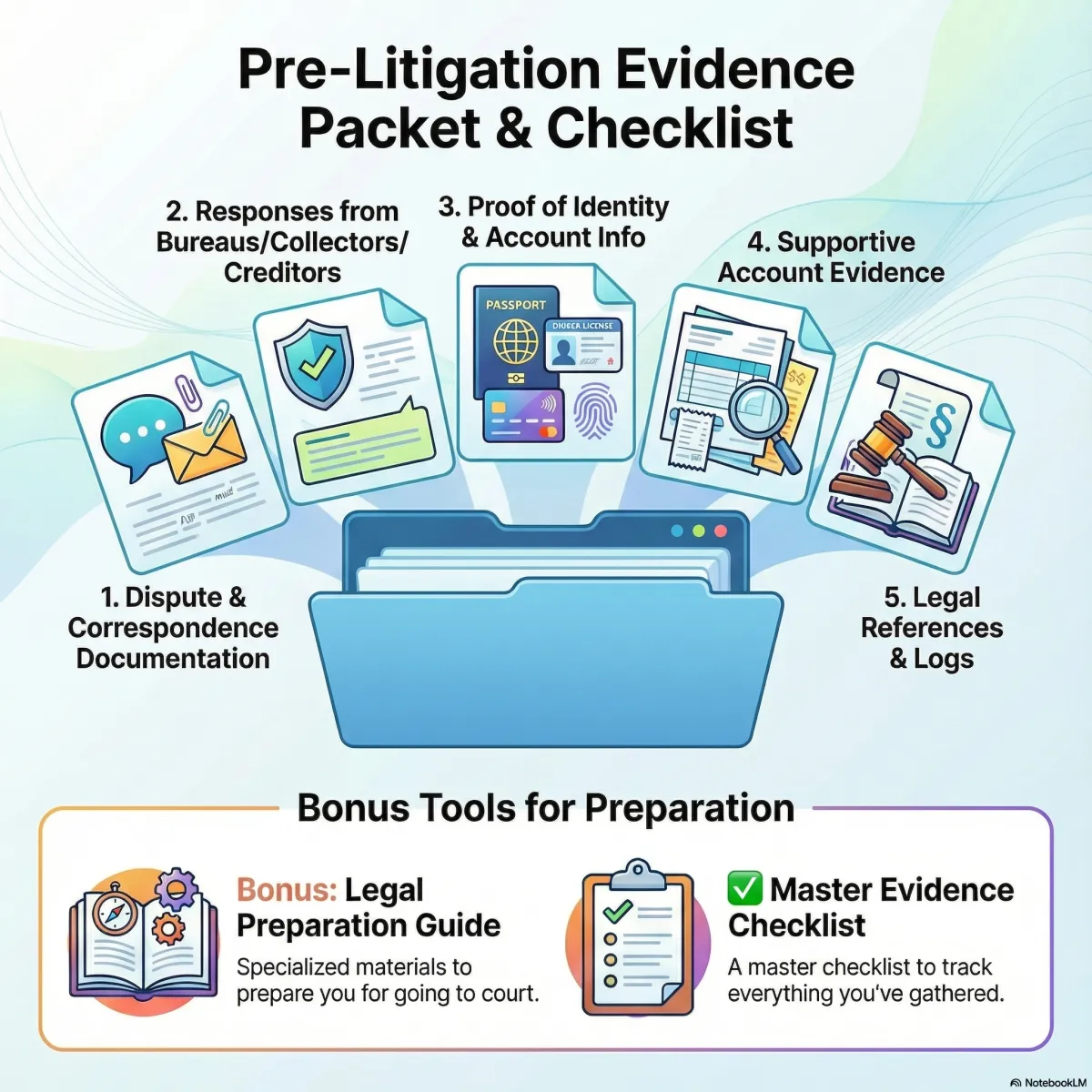

Pre-Litigation Evidence Packet + Checklist

Google Doc.

A structured packet that organizes violations, letters, receipts, and documentation—positioning you for strong escalations when bureaus don’t comply.

$97 DOLLAR VALUE

INCLUDED

If You Just Follow Random Credit Repair Tips,

you’re no different than someone

sending letters into the void and hoping something magically works.

Treating your credit like a guessing game, instead of the legal process it actually is.

Real people need to understand a few key things before they can fix their credit the right way.

I’m not saying credit hacks never work, sometimes they do.

I’ve seen people get lucky before.

But I’ve also watched far more people get better results, in less time, with fewer headaches

because they understood the system first.

People need context, they need awareness, and they need the right beliefs in place

before their efforts have the highest chance of leading to deletions and score jumps.

Imagine how much easier credit repair would feel if you already knew how bureaus verify accounts,

why identity cleanup boosts results,

and what steps legally force them to respond.

Imagine how much more confident you’d be taking action

if you already understood the blueprint successful repair companies use behind the scenes.

How would that kind of framing change your results compared to sending a blind dispute and hoping for the best?

I recently watched someone spend months disputing a collection.

Every time, they got the same “verified” response.

And the reason was simple—

they didn’t understand the process they were trying to use.

Once they learned the order, the laws, and the escalation steps… everything changed.

They saw deletions.

They saw points rise.

They saw approvals come back.

All because they used an education-first strategy instead of a random-letter approach.

It’s time to adapt to credit repair that actually works.

It’s time to get better results with less effort instead of tolerating slow progress and repeated verifications.

It’s time to finally repair your credit with a system designed for today’s world.

Here's A Quick summary Of everything You’re Getting For Just $997 $97.00 Today

just $97.00 now - PRICE GOING UP to $497 SOON!

giving Credit Where Credit Is Due

Credit Removal Letters #1

Credit Repair Send Strategy #2

Dispute Tracker Checklist #3

Pre-Litigation Packet + Checklist #4